By Ted Janicki, President, Bank of America, Buffalo

At Bank of America, fostering a diverse and inclusive workforce is core to who we are as a company and how we drive responsible growth in the markets we serve. Implementing these values begins at the very top at Bank of America – CEO Brian Moynihan chairs our Global Diversity & Inclusion Council, which plays an important role in setting company-wide goals and executing the strategies needed to achieve them. These goals are reflected throughout our employee networks, local partnerships, and our commitment to advancing racial equality and economic opportunity.

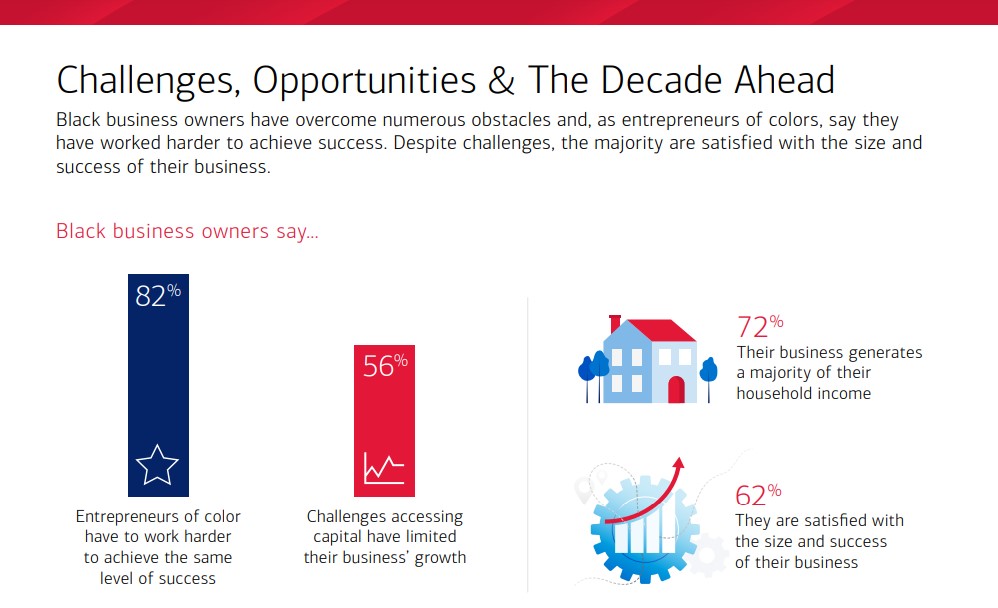

Last year, Bank of America released two Black Business Owner Reports to examine business trends, the impact of the pandemic, and the everyday challenges of small business ownership through an equity lens. The summer report found that 93% of Black small business owners intended to obtain some type of funding for their business in the upcoming year – most of the business owners surveyed also expected their businesses and the economy to rebound. The majority of respondents (56%) in the February report also noted that challenges accessing capital limited their business’ growth. These results are profoundly troubling and underscore the urgency to improve Black entrepreneurs’ access to crucial resources and capital.

As we celebrate Small Business Month and Buffalo’s entrepreneurs during May, it is imperative to recognize that access to capital is critical – especially for minority-owned companies, which were disproportionately impacted by the pandemic. Bank of America directly engages with minority-owned businesses to ensure they have access to the tools and resources needed to secure funding, including EforAll Buffalo. Our network of community development financial institutions including Pathstone Enterprise Center, also works to expand access to capital for business owners who have historically been denied or faced barriers when applying for financial assistance. Here in Buffalo, we also work with the Buffalo Niagara Partnership to create opportunities for small business owners through the newly launched Minority-Owned Business Initiative, which created an underwriting fund to sponsor new BNP memberships.

Our internal goals, research, and local partners are examples of how Bank of America is working towards advancing racial equality and economic opportunity in Buffalo. By understanding our communities and local business owners, we can better invest in the guiding principles of diversity and inclusion to make Western New York a better place for all.

About Bank of America:

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services.

About the Author:

Ted Janicki is the Buffalo market president and Upstate New York/Western Massachusetts small business banking market executive for Bank of America.

As market president, Ted is responsible for connecting the banking and investment resources offered through Bank of America’s eight lines of business to companies, families and individuals across Erie and Niagara counties. He also leads the effort to deploy Bank of America’s resources to address social concerns, strengthen economic opportunity, and build strong communities, as well as supporting the health, safety and engagement of local teammates.

Disclaimer: The above commentary entails the views of the author and not necessarily the views of the Buffalo Niagara Partnership.

The post Expanding Resources for Minority-Owned Businesses appeared first on Buffalo Niagara Partnership.